Beyond Nvidia: 3 AI Stocks Poised to Surge Big Time in 2025

/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

2025 hasn’t been as easy for atificial intelligence (AI) stocks as many thought it would. Tech-oriented firms have faced constant pressure over their growth and ability to deliver earnings from their AI investments. External factors such as volatile trade policies and China’s advancement in AI have also weighed on shares. Lastly, there have been concerns surrounding market saturation and regulatory challenges.

Despite these challenges, the industry has still experienced strong growth driven by generative AI, automation, AI-driven analytics, and record-breaking valuations.

Amid the rush, Wedbush has listed 30 AI stocks to watch.

Wedbush’s AI List

Senior Wedbush analyst Dan Ives has labelled AI as “the biggest tech transformation in over 40 years.” The analyst estimates the global AI market to grow to $407 billion by 2027 and $1.81 trillion by 2030, at a compound annual growth rate of 36%. As a result, Ives has curated a list of 30 AI stock key to the revolution.

Ives divided the list based on segments such as semiconductors and hardware, hyperscalers, consumer internet, cybersecurity, software, and autonomous and robotics. In the list, Ives has picked out market leaders such as Nvidia (NVDA), Taiwan Semiconductor Manufacturing (TSM), Alphabet (GOOG), Apple (AAPL), and many more, but has also highlighted stocks that get less time in the spotlight.

Ives picked Salesforce (CRM) as a favorite in the customer-relations management (CRM) industry. Analysts are optimistic about its Agentforce platform. Another top pick was International Business Machines (IBM), which continues its investment in AI for productivity growth.

Lastly, Ives has picked cybersecurity stock Palo Alto Networks (PANW) due to its position as a beneficiary of increasing cybersecurity demand. Wedbush analysts believe the company’s ability to combine services into a single platform will be a key factor in gaining market share.

AI Stock #1: Salesforce

Salesforce is an industry-leading cloud computing solutions provider. The company provides customer relation management, data management, and artificial intelligence services.

Salesforce posted its fourth-quarter results in late February, posting a profit of $1.71 billion. The figure can be translated to $2.78 per adjusted share while beating analysts’ $2.60-per-share estimate. The company generated $9.99 billion in revenue, slightly below Wall Street’s $10.02 billion estimate.

For the ongoing quarter, Salesforce's outlook anticipates earnings in the range of $2.53 to $2.55 per share with revenue of $9.71 billion. Full year 2025 earnings are expected between $11.09 to $11.17 per share with revenue ranging from $40.5 billion to $40.9 billion. The company reports its Q1 results after the market closes today, May 28.

Analysts have a “Strong Buy” rating on Salesforce with a mean price target of $362.59, reflecting upside potential of 32%. The stock has been reviewed by 47 analysts, receiving 35 “Strong Buy” ratings, three “Moderate Buy” ratings, seven “Hold” ratings, and two “Strong Sell” ratings.

AI Stock #2: International Business Machines

International Business Machines proides hardware, software, and consulting solutions, and its business is entrenched in cloud computing and artificial intelligence.

IBM posted its first-quarter results on April 23, revealing a profit of $1.06 billion, translated to $1.60 per adjusted share. The figure beats analysts’ $1.42-per-share estimate. IBM had revenue of $14.54 billion during the quarter, exceeding experts’ $14.45 billion estimates.

IBM’s management also released its Q2 guidance where it expects revenue between $16.4 billion and $16.75 billion.

Analysts have a consensus “Moderate Buy” rating on the stock along with a mean price target of $249.68, lower than its current trading price. The stock has been covered by 20 analysts and has seven “Strong Buy” ratings, one “Moderate Buy” rating, 10 “Hold” ratings, and two “Strong Sell” ratings.

AI Stock #3: Palo Alto Networks

Palo Alto Networks is a cybersecurity company that provides its services to businesses, private companies, and government agencies. The company offers security analytics and automation, threat intelligence, cloud security, security counseling, and more.

Palo Alto posted its fiscal third-quarter results on May 20, posting a profit of $262.1 million or $0.80 per adjusted share. The figure exceeds market experts’ $0.77-per-share estimates. The California-based company generated $2.29 billion in revenue, topping the estimated $2.28 billion.

Additionally, the company’s Q4 guidance predicts revenue in the range of $2.49 billion to $2.51 billion, while full-year revenue is expected between $9.17 billion to $9.19 billion.

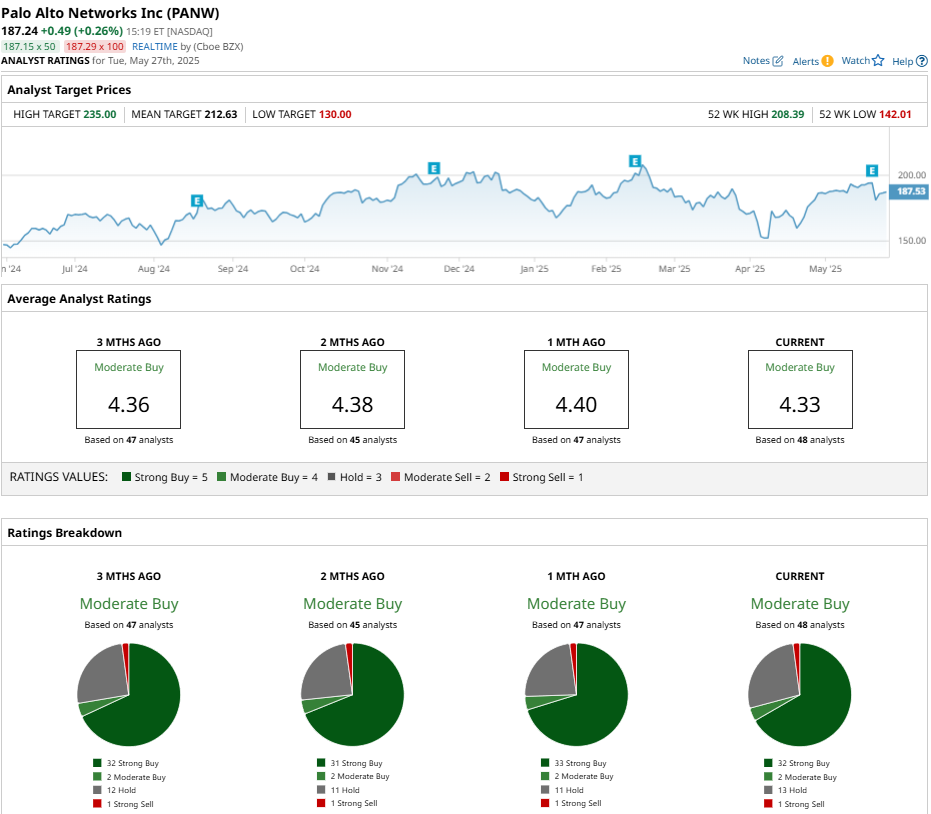

Analysts have a “Moderate Buy” rating on the stock with a mean price target of 212.97, reflecting upside potential of 13%. The stock has been covered by 48 analysts in total and has received 32 “Strong Buy” ratings, two “Moderate Buy” ratings, 13 “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.